Buys and sells during Beaver Creek week.

Star Royalties released the investor update from their AGM.

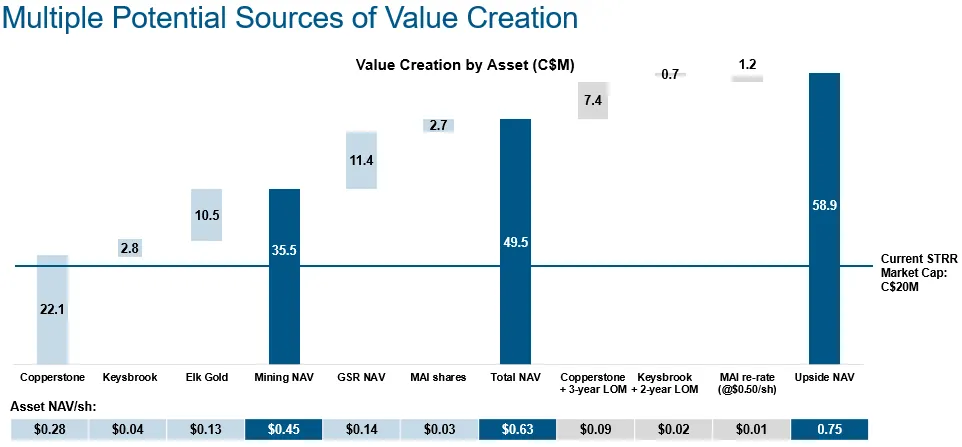

Nobody disputes the value of the STRR portfolio, the issue is who is best suited to crystallize that value for shareholders before it’s eaten up by the G&A costs of running a public company.

I was stopped out of my Kingfisher Metals position at 40.5 cents. I don’t normally use stops but it seemed like a good idea as drill results were due out and I wasn’t actively monitoring the market during the conference (I didn’t realize the position was fully liquidated until I landed in Toronto).

Under normal circumstances I’d hold through and wait for more data, but Kingfisher wasn’t a large position and I spent almost an hour with Orogen Royalties management at Beaver Creek. I’d rather lock in my KFR profits and get my HWY 37 exposure through OGN. Orogen also comes with Ermitaño expansion and a potential monster royalty in Colombia among other things. I was a buyer up to $2 this week.

New undisclosed position: I’ve started nibbling away at an illiquid special situation. I think there’s a spin out coming.

Speaking of spin outs, NGEx Minerals shareholders approved the LunR Royalties spin out.

Mayfair Gold is raising $35-million to move Fenn-Gib forward.

Altius Minerals touched an all-time high.

Comstock lives! It’s trading above the $2.25 deal price.

As a smart investor pointed out to me, anyone who sold LODE for the tax loss on August 12 could buy their position back this week.