There’s silver in them panels.

I’ve always described Comstock Inc. as a commodities holding company in the process of breaking itself apart.

Bioleum

The pre-revenue sustainable aviation fuel business has been hived off. The goal is an eventual NYSE listing. That was important for me as it means no future cash drain on Comstock. I’ve always valued Bioleum as a call option.

Comstock Mining

Not in production and up for sale. Which makes sense given the return profile and the timeline for the metals business. For the purposes of our stress-tested valuation, this can also be valued as a call option.

Land

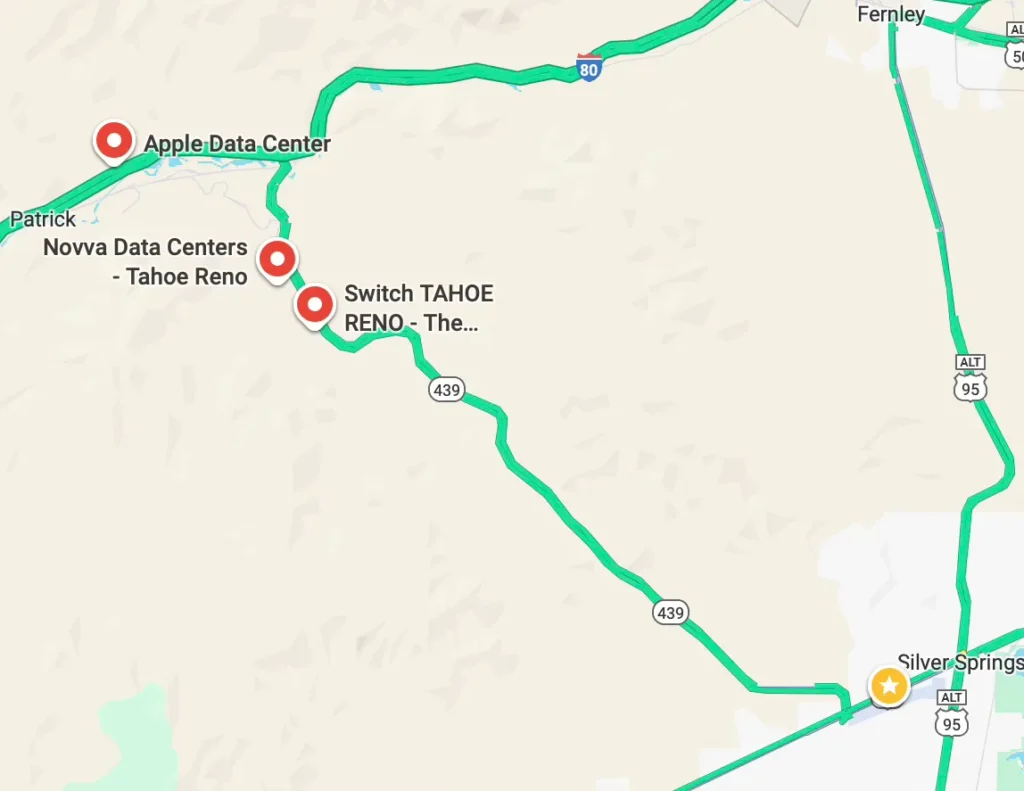

The map tells the story. The red dots are just some of the data centres along Interstate 80 and the USA Parkway (439) in the Tahoe Reno Industrial Center. The star is the Silver Springs airport, which isn’t much to look at today but the use cases are obvious given where it’s located.

Comstock owns multiple land packages adjacent to I-80 and the USA Parkway. Those acres are located amongst existing data centres in the TRIC. LODE also owns 100 acres near the airport, which will be used for a future industrial aviation park. The airport land could be sold outright. Or LODE could structure a ground lease transaction where it continues to own the dirt underneath any future buildings that are constructed and maintained by someone else. The numbers start getting stupid when you see what comparable land is selling for and how much of it Comstock has, including LODE’s 17% stake in the nearby Silver Springs Opportunity Fund. That said, it’s raw land. Let’s call the Opportunity Fund a speculative land bank and value the rest of the land at $50-million.

Comstock Metals

That leaves the solar panel recycling business. The purpose of the visit was to understand the following:

- Does Comstock have access to feedstock?

- Will they be able to process at scale?

- Are they so far ahead a well-financed competitor wouldn’t bother trying to build and scale to take market share?

- What is it all worth?

Comstock is currently processing panels at their demonstration plant. The site will eventually house a full-scale recycling plant with the demonstration plant transitioning into a research and development facility.

Currently panels are arriving in northern Nevada from across the country. Their logistics and decommissioning business originated from customers calling them up and asking them to take the solar panels away for them. Tipping fees may eventually disappear but in time the decommissioning business could more than replace that revenue stream.

Those panels are eventually broken down into their component parts – dense bags of glass, aluminum and metal fines.

Comstock gets paid only on the silver in those bags of metal fines (the aluminum and glass are in separate bags and they get paid on that as well). If that changes, cash payment for the other metals in the fines would drop straight to the bottom line. LODE forecasts each facility can generate $50-million dollars in earnings – or $1 in annual EPS – at a construction cost of $12-million. Last month’s equity offering and the dilution that came with it make sense in the context of moving quickly to outflank the few competitors in the market, all of which appear to be sub-scale with inferior technology. A second facility is on the roadmap.

What’s $1 of EPS worth on a growth business with a proprietary process, a long-term pipeline of feedstock, significant net operating losses and advanced logistics capabilities? Combined with two call options and $1 per share in hard asset value, the right answer is more than $2.50. I’m planning to add to my Comstock position.