As of August 15, 2025

Comstock equity offering

LODE shares dropped through the floor after announcing an equity offering that takes shares outstanding from 35-million to 49-million.

I was a buyer below $2.50 as the company is now fully funded with more than $25-million in cash to ramp up its solar panel recycling operation. They’ve also cleaned up all the legacy liabilities from previous failed acquisitions.

Dilution is never good but it wasn’t unexpected and it’s nowhere near my stress tested valuation. Execution risk is real and that’s a factor each investor has to evaluate for themselves, but this is now a company with a bullet-proof balance sheet. We’re on the path a $1/share of EPS with positive surprises possible as non-core assets get monetized.

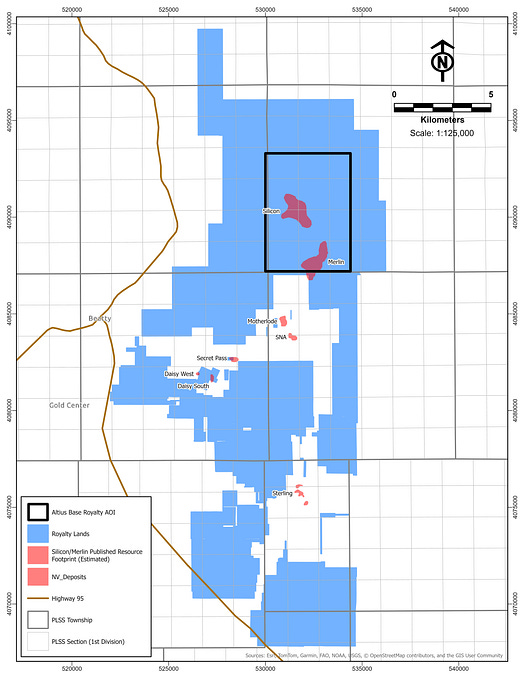

Altius Minerals gets the full bag

ALS.TO is in line to receive the full USD$275-million payment from Franco Nevada for Silicon. Altius won an arbitration hearing that backs its interpretation of the area of interest for the Silicon royalty.

“The final award meets the royalty area requirement set out in the recent sales agreement between Altius and Franco-Nevada Corporation for a 1.0% NSR royalty that is to cause an additional US$25 million contingent payment to Altius, following the expiry of any relevant appeal or challenge periods.”

Altius still holds a 0.5% NSR on Silicon.

Other updates

- Aecon announced a renewed share buyback for 5% of the float.

- NGEX says its royalty spinout will take place as soon as it receives approval to list the spinco on the TSXV. I added more NGEX Mineralswith some of my liberated Minera Alamos cash.

- Triple Flag and Gold Royalty are flush. In the case of GROY, cash flow from $3000 gold and increasing GEOs is facilitating a rapid transfer of value from debt to equity holders (convertible debentures are now well into the money, leaving a line of credit as the only significant debt). With TFPM.TO trading above $36, my Orogen spinco shares are well into negative cost base territory. I’ll be thinking more about taking partial profits in these positions in the next few weeks.

Updated Portfolio

Mining

- KGCRF – Kinross Contingent Value Rights

- Mayfair Gold

Industrials

- Comstock Inc. – Silver

- Aecon – Nuclear

Royalties

- Gold Royalty Corp. (20% Warrants, 80% Common shares)

- Triple Flag Precious Metals

- Altius Minerals

Exploration/Prospect Generators

- Kenorland Minerals

- Orogen 2.0

- Kingfisher Metals

- Vulcan Minerals

Specials/Workouts

- NGEx Minerals

- Chibougamau Independent Mines

- Star Royalties

Eagle Royalties(Exiting portfolio upon completion of RTO/resumption of trading)

Raw Commodities

- Sprott Physical Uranium Trust