More turnover than I usually like over the last few weeks, but in a royalty-and-special-situations-focused mining portfolio, there’s going to be a lot of movement when consolidation finally comes.

Selling

Metals X is cash rich but I can’t figure out what they’re doing. I don’t know anyone else who does either.

Their plan to consolidate ownership of the Renison tin mine by acquiring up to 28% of Greentech’s shares ended with only 3.1% of shareholders tendering to the unsolicited offer. So add Greentech to the odd mining portfolio Metals X is accumulating. At the end of the day, I’m no tin baron. I’ll take my 16% gain over a few months and consider myself lucky this didn’t blow up in my face. This isn’t my game and I made a mistake buying MLX.

As mentioned previously, I sold RMCO after the Bitcoin treasury fiasco. I’ve also mostly completed the process of selling CVR Partners for $89+ per share.

UAN has returned most of my cost base in distributions and I’m sitting on a small profit based on my purchase price. But this is a failed investment considering opportunity cost and the loopholes I had to thread because of the tax issues with US MLPs.

Buying

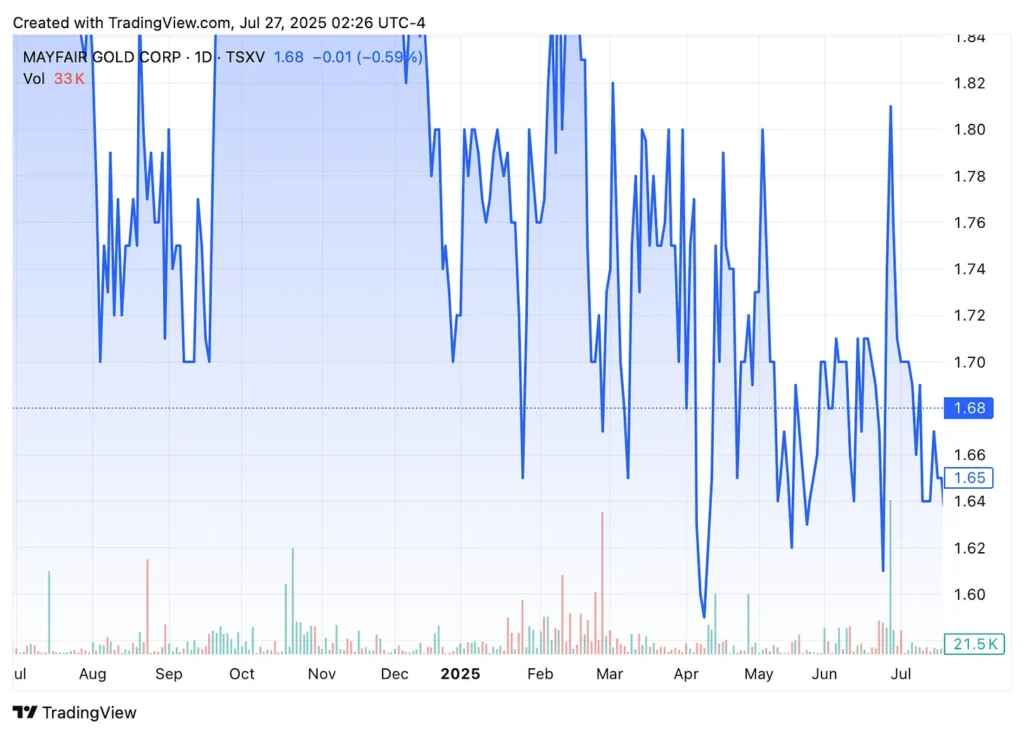

I bought a toehold position in Mayfair Gold while I do more research. I’m not sure I believe in the Lassonde curve, but if I did it wouldn’t look like the sine wave it’s always portrayed as. More like deep and wide valleys broken up by tall peaks with sheer cliffs. Mayfair is currently in the valley.

Muddy Waters won control of Mayfair in a 2024 proxy battle that replaced the board. If you’re looking to understand how the Muddy Waters/Mayfair team thinks about value creation in the mining sector, here are two great interviews.

- Darren McLean with Andrew Walker on investing in the mining sector.

- McLean talking to Money of Mine about specific examples of value creation.

This could be a long-term hold if Mayfair intends to build the Fenn-Gib mine rather than sell, but one that should generate a good IRR over the holding period.

I always thought about the sale of Orogen’s Silicon royalty as something that would set the table for Altius Minerals to do the same with their 1.5% Silicon NSR. Brian Dalton has never been comfortable with the trading multiple gold royalties fetch in relation to base metals – and he moved quickly to capture that premium by selling to Franco Nevada for $375-million. It’s a fair deal for both sides as part of the all cash payment is contingent on an arbitration ruling. Altius also keeps some upside by holding onto 0.5% of the NSR. I added this back as a full position.

NGEx Minerals is a special situation based on the future royalty spinout. In a copper bull market with the Lundin premium in place, I expect I’ll eventually be able to sell the NGEx shares for a profit, leaving me with a zero or negative cost base on two cornerstone development royalties (Los Helados and Lunahuasi). When things are free the timeline to production, the problems of building at elevation and the geopolitical stresses of a deposit sitting on an international border are less of a concern.

The big reveal … GROY

I have this friend. When he was in high school he got a handjob in the parking lot of a McDonalds from Dirty Gail. I don’t know Dirty Gail personally, but it’s not the nickname you get for winning the science fair. He’s not proud of it, but as he explained it to me there just comes a point where you can’t say no. In this analogy Gold Royalty Corp. is Dirty Gail. GROY common shares between $1.35 and $1.75 – and warrants between 20 and 25 cents – are the point where you can’t say no. I’m not proud of going into business with the worst capital allocators in the royalty space this side of Ecora, but a potential 5-bagger on warrants that have two years to expiry and a strike price more than 30% below net asset value? That opportunity only comes along when a management team has completely shredded its credibility. I had to keep my mouth shut while I bought as many warrants as I could stomach. There are indications based on recent hires and the messaging from last month’s capital markets day that GROY is not going to do anymore stupid deals.

The last time I was this ashamed of an investment was infamous Venture Exchange rollup Patient Home Monitoring. PHM dropped as low as 14 cents before splitting into two companies that both ended up as multi-baggers. The risk with GROY is a stupid deal that just craters the share price and the progress of the last six months.

Portfolio company updates

The first open pit mining permit issued by the Mexican government during the Sheinbaum administration goes to Heliostar Metals. SEMARNAT granted a change of use permit with modification for tailings in Durango.

In July 2025, Heliostar complied with all required applications and received the required approval to undertake this open pit expansion. The relevant application was submitted in Q4, 2024. Further, the Company has also received a variance to its environmental impact assessment (MIA) to increase the height of the San Agustin leachpad from 77 to 88 metres in height.

The news sent Minera Alamos surging above 45 cents as the expectation is that open pit permits for other existing Mexican concessions will start flowing.

Atlas Salt put out another release on project financing for Great Atlantic, while Vulcan Minerals is talking about its exploration process. I remain convinced we see an equity financing from one or both in the coming weeks.

Banyan Gold has taken advantage of the Victoria Gold bankruptcy to consolidate its ownership of the AurMac deposit, negotiating better pricing and terms with the court-appointed receiver. My current plan is to wait for the combined Eagle Royalties/Summit Royalties to begin trading to exit ER.CN. But if Banyan keeps making smart deals and the grades aren’t terrible, the AurMac royalties inside Eagle could have real value.

My other takeaway is that $3000 gold solves a lot of problems, so Victoria Gold/Eagle Mine will emerge from bankruptcy with a new owner. The independent review went out of its way to blame the Eagle tailings failure on the operator.

Updated Portfolio

As of July 25, 2025

Mining

- Minera Alamos

- KGCRF – Kinross Contingent Value Rights

- Mayfair Gold (new position)

Industrials

- Comstock Inc. – Silver

- Aecon – Nuclear

CVR Partners – Urea(liquidating)

Royalties

Undisclosed Royalty Co.revealed as Gold Royalty Corp. (20% Warrants, 80% Common shares)- Triple Flag Precious Metals

- Star Royalties

- Altius Minerals (new position)

Royalty Management Holding Company

Exploration/Prospect Generators

- Kenorland Minerals

- Orogen 2.0

- Kingfisher Metals

- Vulcan Minerals

Specials/Workouts

Metals X(Sold)- NGEx Minerals (new position)

- Chibougamau Independent Mines

Eagle Royalties(Exiting portfolio upon completion of RTO/resumption of trading)

Raw Commodities

- Sprott Physical Uranium Trust

Interesting links

Teck Resources will extend the life of Canada’s largest copper mine by two decades. This analysis of Teck by Divestor is still the best I’ve seen.