All things being equal, I’d rather invest in a royalty or patent business. Much simpler to cash a cheque than dig something out of the ground so it’s a sub-sector I track pretty closely. If you need convincing this is a nice ramble on valuing royalties I’ll be saving for future reference.

Sailfish and Sandstorm

Whatever you think of the delivery, Mark Turner’s IKN blog does a good job documenting the history of Sailfish Royalty’s silver asset and extrapolating the likely returns.

He also goes through the latest quarter from Sandstorm Gold in detail. Most useful for me was the historical context of how badly management has allocated capital.

Osisko Gold Royalties

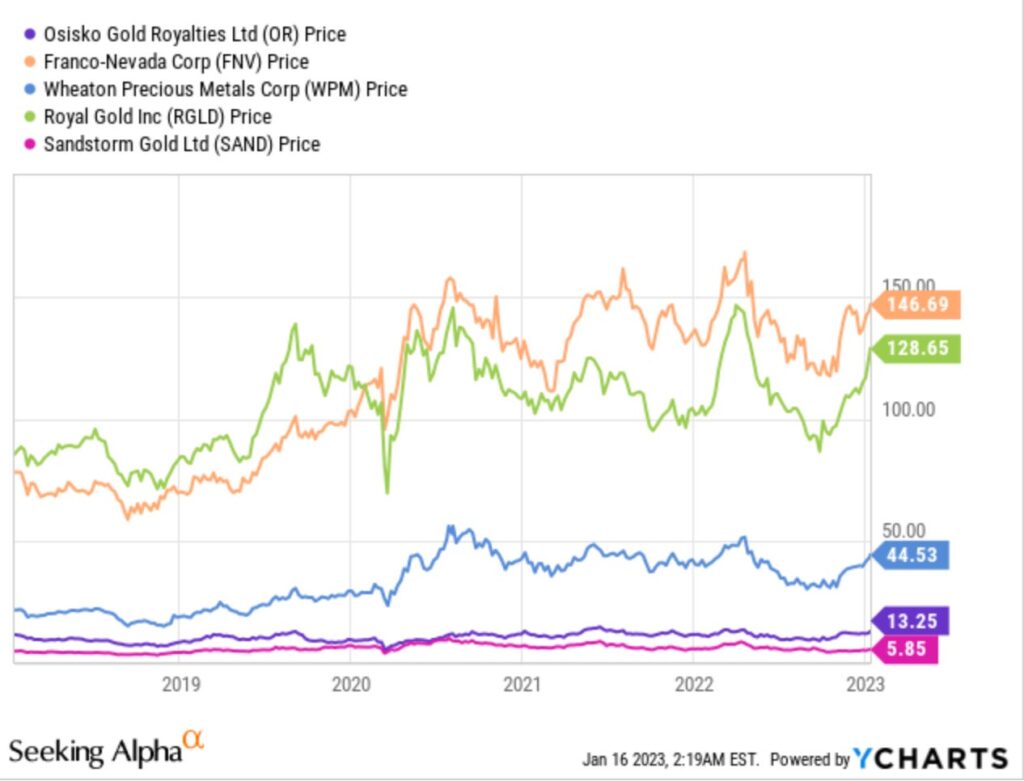

The Sandstorm analysis confirmed the consensus valuation of Sandstorm and Osisko Gold Royalties, a stock I dumped because they couldn’t sit still and cash their royalty cheques. I really wanted to like CEO Sandeep Singh and his plan to close the valuation gap with Franco, Royal Gold and Wheaton by buying back shares and streamlining the company’s assets.

But I ultimately learned that you can’t judge management by what they say, only by what they do. Particularly when they do it over and over.

Historical missteps are reflected in the long-term stock price.

The performance of OR is even more disappointing considering the other company that started life with a Malartic royalty dropped into its lap was Abitibi Royalty. Abitibi was one of the best performing stocks on the TSX for years before it was taken out by Gold Royalty last year. Abitibi followed a simple plan of returning cash to shareholders and not shooting itself in the nuts with a staple gun every few years by pursuing some convoluted deal.

Osisko may succeed in changing hearts and minds eventually, but I’ll be watching from the sidelines this time.

Listings

Empress Royalty upgraded its US listing to be 35% less shitty. What isn’t shitty is the performance of the stock since announcing, and closing, a private placement last year.

Vox Royalty rang the bell at the Nasdaq and now has a full US listing under the ticker VOXR.