Here’s a rhetorical question: What is your third job and how much do you get paid to do it?

If you’re like me, your third job after work and family involves landscaping and boxwood shrubs. Your pay is a mediocre attaboy and perhaps a domestic beer.

If you’re Iqbal Khan, your third job is CEO of Parkit Enterprise, a TSXV-listed industrial real estate roll up with some additional parking assets and a market cap of more than $340-million.

Mr. Khan has over 20 years of senior management experience, including as CFO and Director of StorageVault Canada Inc. (“StorageVault”), CFO and Principal of the Access Group (“Access”), both of which he will continue, and was the prior President of RecordXpress, a records management business. At StorageVault and Access he focuses on the acquisition, financing, management and development of storage, industrial, multi-residential and commercial real estate in Canada.

Parkit news release, June 28, 2021

There are benefits to having a CEO who must see a lot of deals, but there are also legitimate questions to be asked:

- Which job takes priority?

- What is the acquisition criteria for each company? Why does Parkit buy any particular asset rather than Access or StorageVault?

That’s just off the top of my head. I’m sure there are other corporate governance concerns when the CEO splits his time three ways.

However if I’m Iqbal Khan, my main concern is income taxes. What’s the point of a third paycheque when you’re losing 50 cents on the dollar to Canada Revenue Agency? That rhetorical question is my way of offering a possible explanation for this options grant, announced on the Friday between Canada Day and July fourth holiday in the United States.

…certain officers and directors have been issued an aggregate of 3,695,000 options pursuant to the Company’s option plan effective June 30, 2021 with each such option being exercisable into one common share at an exercise price of $1.50 at any time on or before the tenth anniversary of its issuance. Each of the options vested on grant.

Parkit news release, July 2, 2021

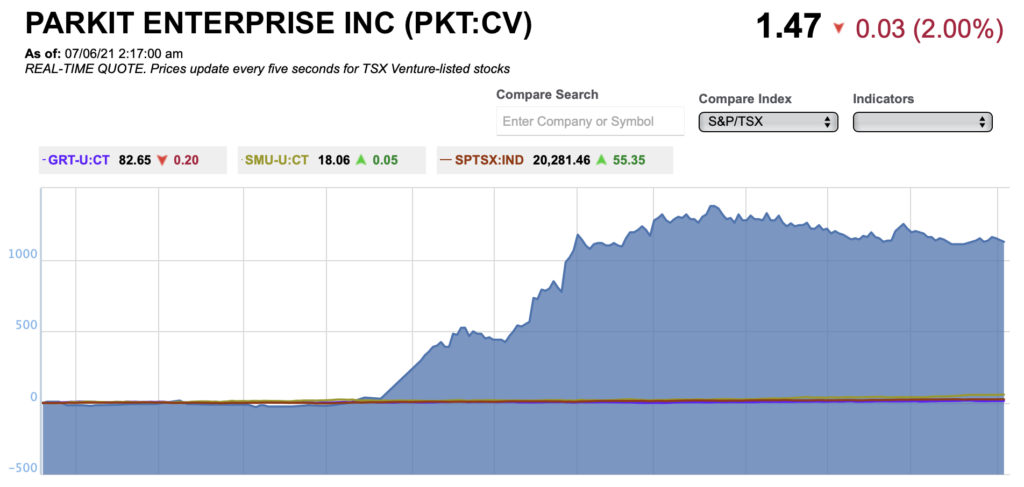

The options grant is tax efficient and egregious. It is also part of an ongoing pattern of insiders diluting shareholders through rights offerings, private placements, options grants and related-party asset sales. I’m sure the company would counter that its largest private placements were accretive to net asset value and directly responsible for executing a successful pivot to industrial properties. Parkit shares traded below 20 cents before the company announced the purchase of its first building in November – and a dilutive private placement to fund it. The share price surged on the news and kept going.

With real estate stocks, Net Asset Value and share price have a tendency to converge over time. At the same time, most retail investors don’t capitalize G&A expenses to get an accurate picture of NAV.

I owned Parkit shares in the past. I have no position currently and don’t see any scenario where I’d buy again – successful investors are selling industrial real estate rather than buying. Consider me an interested observer of how Parkit eventually arrives at that convergence of NAV and share price.